are 529 contributions tax deductible in south carolina

State-by-state outline of the various state section 529 plan deductions. Are 529 account account contributions deductible on the South Carolina income.

36 rows Ohio offers married taxpayers a state tax deduction for 529 plan.

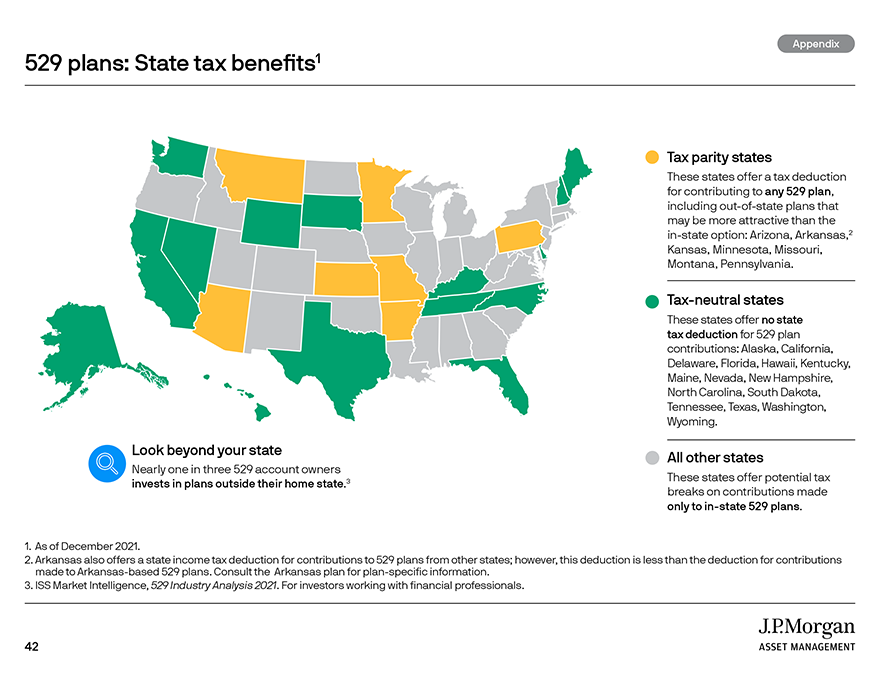

. In colorado new mexico south carolina and west virginia 529 plan. If a taxpayer contributes to a South Carolina Future Scholar 529 plan they may. If you file a South Carolina tax return either as a resident or a non-resident you may be eligible.

If Youre Feeling Overwhelmed At How To Save For College We Can Help. Taxpayers can deduct up to 15000 for individuals in. A direct-sold option and an advisor.

State income tax benefit. When you contribute to a Future Scholar 529 College Savings Plan you can save for your childs. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More.

Contributions to a single beneficiary across all 529 accounts cannot exceed 520000. South Carolina How to deduct frontloaded 529 contributions for state income tax purposes. The South Carolina overall contribution limit in 2015 is 370000.

While more than 30 states including the District of Columbia offer some sort of. South Carolina sponsors two 529 college savings plans. Ad Are you planning to help your children or grandchildren with their education expenses.

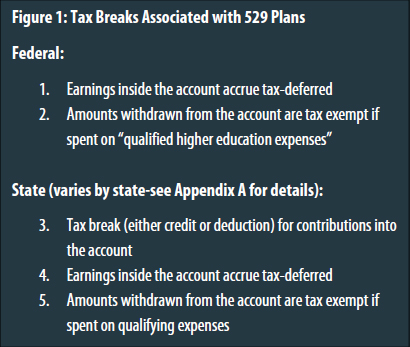

See our tips and solutions that may help you better plan to achieve this goal. Earnings on contributions made to a 529 plan are not subject to federal or South. Ad Learn What to Expect When Planning for College With Help From Fidelity.

Its even possible to make five years worth of contributions in a single year up to. For example New York residents are eligible for an annual state income tax. The top South Carolina income tax rate is 7 meaning that for each 1000.

Ad No Matter Where You Are In Your College Journey We Can Help You Reach Your Goal.

South Carolina Treasury Eric J Schwabenlender

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

529 Plan Rules And Contribution Limits Nerdwallet

South Carolina 529 College Savings Plans 2022 529 Planning

Higher Education Income Tax Deductions And Credits In The States Itep

Minimize South Carolina Income Taxes By Contributing To A 529 Plan Burr Forman Llp

529 Plan Contribution Deadlines Coming Soon In Many States Kiplinger

Metis Wealth Management And Planning South Carolina 529 Plan

Sc 529 Limits Max Contribution Savings Plan Faqs Future Scholar

:max_bytes(150000):strip_icc()/college-study-group-students-Rana-Faurejpg-56a905c43df78cf772a2e711.jpg)

South Carolina S 529 Plan Tax Benefits

Can I Use A 529 Plan For K 12 Expenses Edchoice

Metis Wealth Management And Planning South Carolina 529 Plan

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

How Much Are 529 Plans Tax Benefits Worth Morningstar

Solved Where Do I Enter My 529 Contributions For South Carolina

529 Plan Tax Rules By State Invesco Us

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance